The UK Campervan & Motorhome Industry: Trends, Statistics from the Last Three Years

Share

The UK Campervan & Motorhome Industry: Trends & Statistics from the Last Three Years

The UK campervan and motorhome industry has been through a remarkable few years. From the post-pandemic staycation boom to a more mature, sustainability-focused market, leisure vehicle ownership has firmly moved into the mainstream. In this article, we take a data-led look at how the sector has evolved over the last three years, and what it means for owners, converters and suppliers.

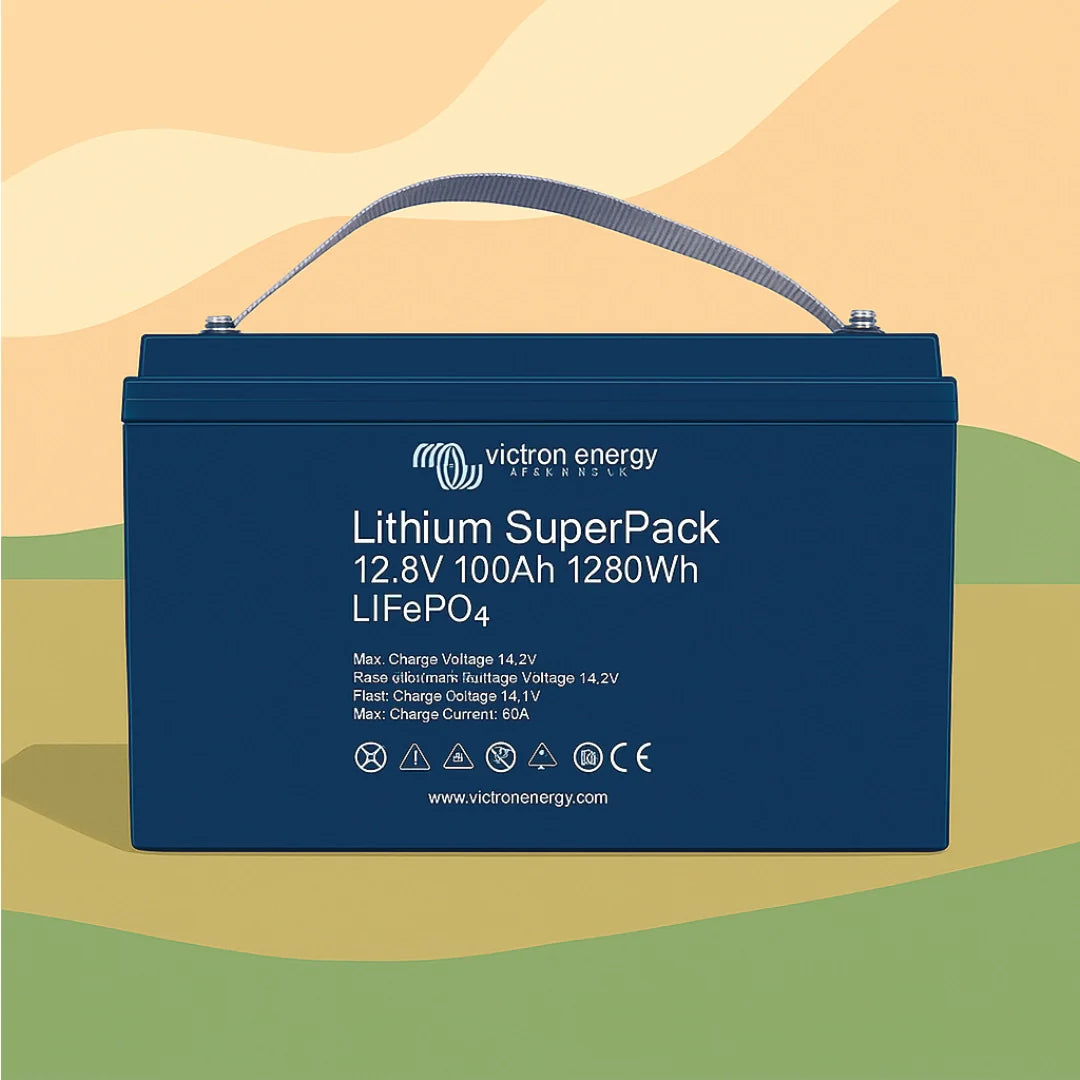

Modern lithium power systems have become a key part of the UK campervan and motorhome market.

Snapshot of the UK Camper & Motorhome Market

While hard numbers vary by source and definition (touring caravans, motorhomes, campervans and holiday parks are often grouped together), several clear trends have emerged:

- Leisure trips have recovered to – and in some segments exceeded – pre-pandemic levels.

- Domestic holidays remain strong as many travellers continue to prioritise UK-based breaks.

- Industry value has grown steadily, supported by higher-spec vehicles, investment in sites and upgraded onboard equipment.

- The motorhome vehicle market itself is expanding, with new buyers still entering the sector and hire/try-before-you-buy models growing in popularity.

Trip Volumes & Demand: The Staycation Effect

After the disruption of 2020–2021, leisure travel in the UK bounced back strongly. By 2022, camping and caravanning trips had recovered to roughly pre-pandemic levels, with tens of millions of nights spent under canvas or in leisure vehicles each year.

Over the last three years:

- 2022: UK camping and caravanning trips rebounded to around pre-pandemic volumes as people continued to favour domestic, flexible holidays.

- 2023: Demand remained robust, with many operators reporting strong bookings, especially in school holidays and key shoulder-season weekends.

- 2024: The market began to normalise, but the habit of “regular UK short breaks” continued, supporting repeat business for campsites and holiday parks.

For campervan and motorhome owners, this has reinforced the appeal of having their own rolling accommodation: freedom to pick destinations, avoid flight disruption and manage costs more predictably.

Off-grid capability – solar and advanced charging – is now a key buying factor for many UK owners.

Economic Impact: A Multi-Billion Pound Sector

The wider caravan, camping and motorhome sector is a major contributor to the UK visitor economy:

- Holiday parks and campsites now generate multi-billion pound visitor spending annually, supporting thousands of jobs across the UK.

- There are more than 2,600 businesses in the caravan and camping site industry, with long-term growth of around 3–4% a year since 2020.

- Caravan and motorhome manufacturing contributes well over £1.8 billion to the UK economy each year, with major brands continuing to invest in new models and layouts.

Beyond these headline figures, thousands of small and medium-sized businesses – converters, fit-out specialists, accessory suppliers and service centres – have grown alongside the core vehicle manufacturers and park operators.

Motorhome & Campervan Fleet Growth

Recent estimates suggest there are now well over three-quarters of a million touring caravans and motorhomes regularly in use across the UK, with that figure forecast to rise significantly by 2030.

Over the last three years:

- The number of leisure vehicles in circulation has continued to edge upwards, boosted by both new sales and a healthy used market.

- Market analysts estimate the UK motorhome vehicles market to be worth around £1.5 billion in 2024, with forecasts pointing to annual growth of around 8% in the coming years.

- New registrations have been influenced by supply chain recovery (post-COVID) and changing consumer confidence, but the medium-term outlook remains positive.

In short: the UK is home to a sizeable and still-growing fleet of campervans and motorhomes, with strong replacement and upgrade demand as owners seek more efficient and better equipped vehicles.

Key Trends Shaping the Last Three Years

1. The Rise of “Rolling Holiday Homes”

For many buyers, a motorhome or campervan is now seen as a long-term lifestyle investment rather than a once-in-a-while purchase. Owners mix shorter weekend trips with longer summer tours, often combining UK and near-Europe travel.

2. Off-Grid & Electrification

With the popularity of remote work, wild camping (where legal) and quieter CL/CS sites, there has been a strong shift towards better onboard power systems:

- Lithium leisure batteries and smart BMS solutions.

- MPPT solar charge controllers and larger roof-mounted solar arrays.

- Integrated 12V/230V systems designed around inverters and high-efficiency appliances.

3. Higher Specification, Higher Expectations

New buyers expect residential-style comfort – quality beds, heating, good insulation, decent showers – and the electrics to support that. This has supported higher average vehicle values and more premium upgrades in the aftermarket.

4. Demographics: Not Just Retirees

While the traditional retired buyer remains core to the motorhome market, the last three years have seen continued interest from:

- Younger couples and families embracing van-life style travel.

- Outdoor sports enthusiasts using vans as mobile bases.

- Remote workers combining travel with flexible working arrangements.

Smart monitoring and control systems are becoming standard in higher-end camper and motorhome builds.

Challenges: Costs, Supply & Site Availability

It hasn’t all been easy. Over the last three years the industry has had to navigate:

- Rising build and running costs – materials, energy and insurance costs have all increased.

- Supply chain disruption – particularly in base vehicles and some key components.

- Pitch availability – popular regions can book up months in advance during peak season.

Despite these pressures, demand has remained surprisingly resilient, with many owners choosing to “trade up” or invest in better-specified vehicles rather than leave the market entirely.

Outlook: Where the UK Camper & Motorhome Sector Is Heading

Looking ahead from the 2022–2024 period, most forecasts point to continued steady growth in both industry value and the active fleet of vehicles. Premiumisation, electrification and smarter onboard technology are likely to remain key themes.

For owners and would-be buyers, that means:

- A strong used market with good resale values for well-specified vehicles.

- More choice in layouts, base vehicles and energy systems.

- Better infrastructure at sites – from EV charging to improved Wi-Fi and facilities.

For converters, installers and suppliers, the last three years have confirmed that the UK campervan and motorhome industry is not a short-term fad: it is an established, growing part of the UK leisure economy with a committed customer base and substantial long-term potential.

Powering the Next Generation of UK Adventures

Whether you’re a first-time buyer browsing dealer forecourts, a DIY converter planning your dream layout, or a seasoned tourer upgrading your electrical system, the data from the last three years tells a clear story: the UK’s love affair with campervans and motorhomes is here to stay.

With better vehicles, smarter power solutions and a thriving network of sites and services, the road ahead for the UK camper and motorhome community looks bright.

*statistic are generalised from a number of sources.

Prev post

The Advantages and Disadvantages of Van Life

Updated on 16 November 2025

Next post

SRNE Eco System Starter Kit – Build the Brain of Your Campervan Power System

Updated on 16 November 2025